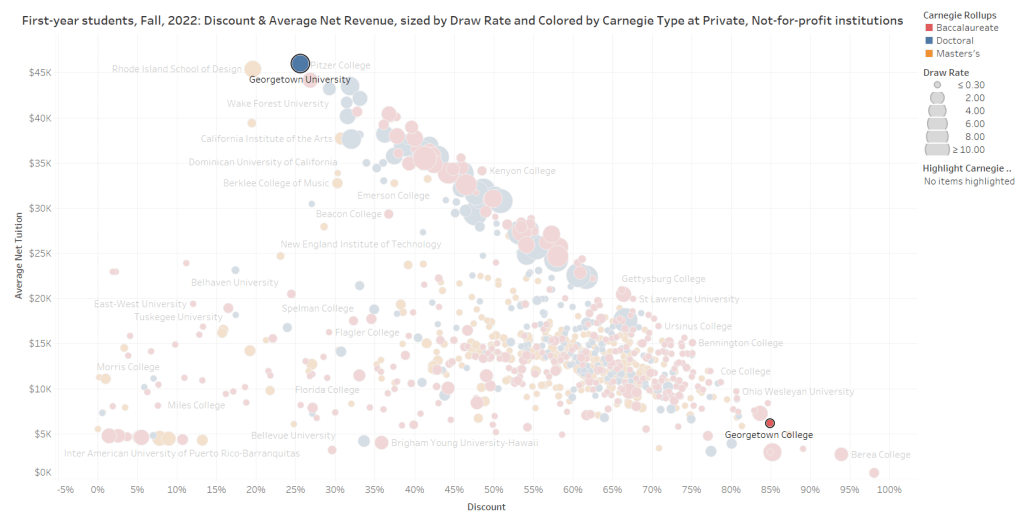

Look at this quick view of Fall, 2022 discount rates (x-axis) and average net revenue (y-axis). The approximately 1,000 bubbles, each representing a single institution, are colored by Carnegie type (a roll up into large categories), and are sized by draw rate. Some quick definitions:

- Discount rate is (Total institutional aid/Total gross tuition revenue).

- Average net revenue is cash received per student after all your discounts. It can be from any source.

- Draw rate is (yield rate/admit rate), and is a proxy for market position, and sorts out the “highly rejective colleges.” Harvard (with a draw rate of 28), Cal Tech (21) and Stanford (20) are in rarified air. The median of the 1,000 colleges here is 0.31.

I noticed that Georgetown University in DC and Georgetown College in Kentucky occupy very different positions on the chart, and in some sense, the spread between them encompasses the whole spectrum of private college higher education. (Click for a larger view).

Georgetown College netted about $6,000 per student on a discount rate of 85%, with a draw rate of 0.31, exactly the median. Its city cousin (actually no relation as far as I can see) nets about 7.5 times that amount, with a draw rate of 3.69, which is still light years from Harvard in that regard, but still an enviable position.

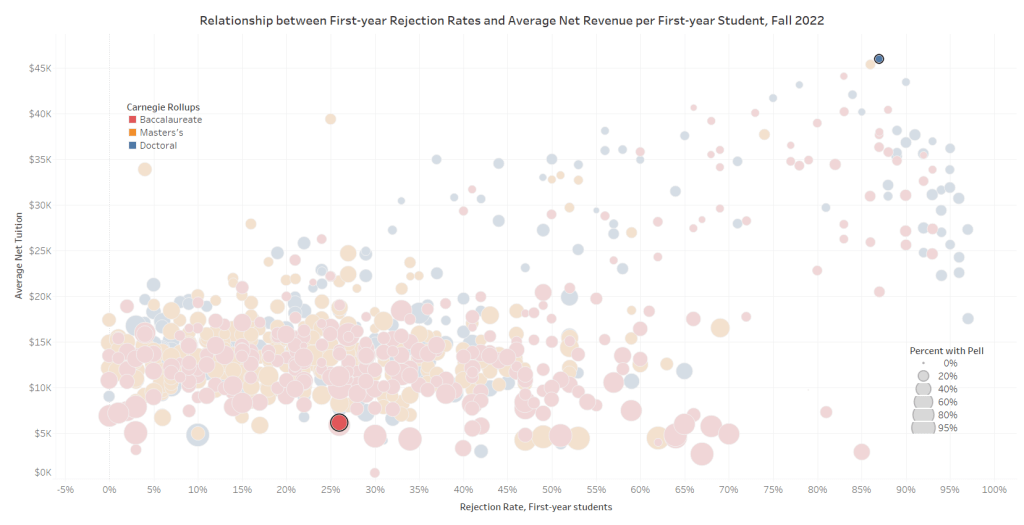

It’s also fun to look at this another way: By looking at the colleges arrayed by selectivity and average net revenue, colored again by Carnegie rollups, and sized by the percentage of first-year students with Pell. You can draw your own conclusions about what this all means, of course, and you can speculate endlessly about cause and effect, but there is one thing that’s very clear: The vast majority of private colleges and universities are clustered together, mostly fighting for the same students, and doing the bulk of the work educating low-income students.

If you have trustees who are mostly focused on discount, it’s important to help them understand that there is a lot more at play in the market of higher education. Discount is an important measure of financial health when taken in conjunction with other financial indicators; a very high discount at Harvard is not the same as at a small college in Oklahoma, for instance. Discount is not a switch you throw, or even a variable you should manage to, unless you’re also attending the larger issues of today’s market realities.

The Georgetowns of the world (not to mention the Notre Dames) define the diversity of the market, but focusing on outliers isn’t always helpful.

Context is critical, and enrollment is complicated.

Discover more from Enrollment VP

Subscribe to get the latest posts sent to your email.

Once upon a long ago time when I worked a a Jesuit university Georgetown was (it claimed and we assumed) the top ranked Jesuit school. The “Harvard of the Jesuits” one might say. Wondering now if that’s still the case or fi there might be a few others with higher draw and lower discount rates. For me, two good indicators of overall market strength.

LikeLike